Over the past decade, the total daily value traded in the US options markets has exceeded that of the US stock markets. So, why is it that you may find financial advisors or advisers reluctant to advocate for the use of options in your investment portfolio?

It’s an interesting question, but I won’t attempt to answer it in this article. I will answer how you may use stock options to possibly exceed your returns on the S&P 500 with slightly more risk and effort that comes with holding broad market index ETFs like $SPY. The 10-year backtest I share here shows that the strategy I present outperformed traditional buy-and-hold index fund strategies by a factor of 50% over the 10-year period. The backtest will also show that in short timeframes where there is a bear market, this strategy also increases losses.

This strategy isn’t suitable for a large portion of your portfolio if your investment goals include a short time horizon. It’s a strategy that’s more suitable for long time horizons spanning decades. If held for many decades, its performance may actually accelerate, as I will show in the backtest. Wild stuff!

This article is geared towards an audience that has little or no understanding of options.

Before we get into the details, please note that this article contains investment information, not investment advice. Consult a financial advisor or adviser before investing.

The strategy at a high level

Here is how the strategy works:

- Purchase two $SPY call options with a strike price at about half the value of $SPY and an expiration date of about a year and a half away. In trading terms, this is called a deep-in-the-money call option because its strike price of is far below the value of the underlying equity by a factor of 50%.

- If the value of $SPY drops by 5% from its value at the time of purchasing the option or time passes to one year after the purchase, close the two option positions by selling them.

- When you repeat step 1, you may need to top up your positions with extra cash to complete the transaction.

That’s it.

Example: if $SPY is currently $600 today on Oct 20, 2024, I will buy two $300 strike price $SPY call option with an expiration near April 20, 2026. This will cost about $60,000. If $SPY drops 5% or one year passes, I will sell those two positions and do another purchase for new call options again with a strike price about 50% of the underlying and an expiration about a year and a half away.

By choosing a deep-in-the-money strike price, you are effectively buying a leveraged position in $SPY with reduced extrinsic value, meaning your options will move almost in tandem with the underlying stock. The change in value of these $SPY call options will typically be one-to-one with the change in value of $SPY unless there hasn’t been a defensive repositioning of the position during a market downturn. This means, in a non-volatile market scenario, if $SPY rose from $600 to $601, a $SPY $300 strike price call option would rise from $300 to $301 in value. $300 invested in this call option strategy yields approximately two times the profit and loss that $300 invested in holding the $SPY ETF yields while providing a similar level of risk.

This is called a deep-in-the-money option strategy because the strike price of the call option, at $300, is significantly less than the value of the underlying value of the option at $600. Let’s explain this strategy in further detail and some risks which you need to be aware of if you use this strategy.

What is an option?

An option is a contract that allows the holder to purchase, in the case of call options, or sell, in the case of put options, the underlying equity at the option’s strike price, typically in batches of 100. The contracts will expire at some expiration date. The option holder can choose to exercise the purchase (for calls) or sale (for puts) or not, which is where they’re called options.

In the example where a $300 strike price $SPY call option is purchased, the option holder can purchase 100 shares of the $SPY ETF if they choose to exercise their position. Most brokerages will auto-exercise options if they’re in the money at the time of expiry and there is enough equity in the account to cover the transaction.

Options can be closed before expiration without exercising the position as long as there is another market participant willing to buy them. I will come back to the topic of liquidity in the options market later.

How are options prices determined?

Answering this with precision is an article all on its own, so I will only share enough information here to explain why this investment strategy works. I have to simplify some details to make my point. If you choose to purchase or sell options, you need to become very familiar with the factors that contribute to options pricing.

Option prices are the sum of two basic components; intrinsic value and extrinsic value.

In-the-money options have intrinsic value. The more in-the-money an option is, the higher the intrinsic value of the option. For example, a $300 strike price $SPY call option has $301 of intrinsic value if $SPY is worth $601. A $590 strike price $SPY call option has $11 of intrinsic value if $SPY is worth $601.

Out-of-the-money options have no intrinsic value. So a $602 strike price $SPY call option has no intrinsic value if $SPY is worth $601. If the value of $SPY rose above $601 to $603, that call option would have $2 of intrinsic value.

Extrinsic value is interesting and a lot fuzzier to calculate and is less applicable to the strategy being proposed so I won’t go deep into explanation here. When a dealer (aka, a market maker) sets a price for an option that you can buy from them, they will price in what they believe is the probability that the option will expire in the money. Options that have strike prices close to the current value of the underlying equity will have high extrinsic value (i.e. the exact opposite of intrinsic value). Extrinsic value works a lot like insurance. If you buy insurance, you will collect an insurance payout if some event occurs. There’s a chance that the event may not occur and your insurance never pays anything. Extrinsic value tends to decrease as the option’s expiration date approaches. It tends to increase during periods of volatility. It’s also affected by interest rates.

Trading options that have strike prices close to the value of the underlying equity have extrinsic value, are very risky, and is an advanced trading technique. Extrinsic value represents risk.

An interesting aspect is that for deep-in-the-money options, their extrinsic value approaches zero as the strike price approaches 50% of the value of the underlying asset, reducing risk for the investor. For example, when $SPY is valued at $600, the dealer expects that a $300 strike price $SPY call will expire in the money, even a year and a half away, so the extrinsic value is approximately zero. So we lower the risk in our strategy by ensuring we take on minimal extrinsic value in our position by performing a defensive repositioning if necessary.

Fun fact: JP Morgan regularly performs a massive advanced options trade called a collar trade to protect their positions. It’s actually quite simple to understand once you get over the learning curve that comes with options. The trade provides downside loss protection and upside profit. The trade is so large that impacts the broader stock market. Look it up if you’re interested.

What happens in a market downtrend

In a market downtrend, $SPY will decrease in value, and the extrinsic value of a deep-in-the-money call option will tend to increase while its intrinsic value decreases. Remember, extrinsic value represents risk to the option holder, so it’s advantageous to minimise it. This is why the strategy includes closing a position that has decreased by 5% in value as a defensive measure.

Example: you purchase a $300 strike price $SPY call option when $SPY is worth $600, the option may be worth something like $271 ($270 in intrinsic value plus a bit extra as it takes on extrinsic value) if $SPY dropped to $570. If you held the $SPY ETF rather than the call option, your position value would have decreased by $30, while the call option didn’t decrease as much due to the increase in extrinsic value.

These examples are meant to be illustrative. Don’t worry though, at the end of the article we will review how this strategy would have performed historically using real world data.

Options prices during extreme volatility and low options liquidity

Think about the rare scenario where the market has dropped 7% in a single day. Options dealers face considerable risk during such an event and they will likely increase the spread between the bid and ask prices they offer. When this bid-ask spread increases, this means you buy and sell at less favourable prices while the dealers protect their position. The dealers may even choose to temporarily not buy back their position from you until the volatility fades. This poses a risk, because this strategy recommends you sell a position in this event to protect yourself. It’s a risk that comes with taking on the increased upside for profits.

Minimum position size, management expenses, and fees

A $300 strike price $SPY call option will cost $30,000 USD, because these options contracts are sold in lots of 100. It may be a lot of money for many investors to put up. Using the strategy with a less costly S&P 500 index ETF is also an option, however, they usually have poorer liquidity and larger bid-ask spreads, so I recommend avoiding that. $SPY options are among the highest demand options in the market, so trading with them typically gives you better prices than alternatives like $VOO which is another S&P 500 index ETF.

$SPY options come with higher fees than simply holding $SPY, but this is expected given the potential profits the strategy can provide, and it’s not a significant factor in the big picture. Management expenses and fees will include the MER of $SPY (currently 0.09%), plus the bid-ask spread for the option, plus your brokerage’s transaction fees.

Backtesting

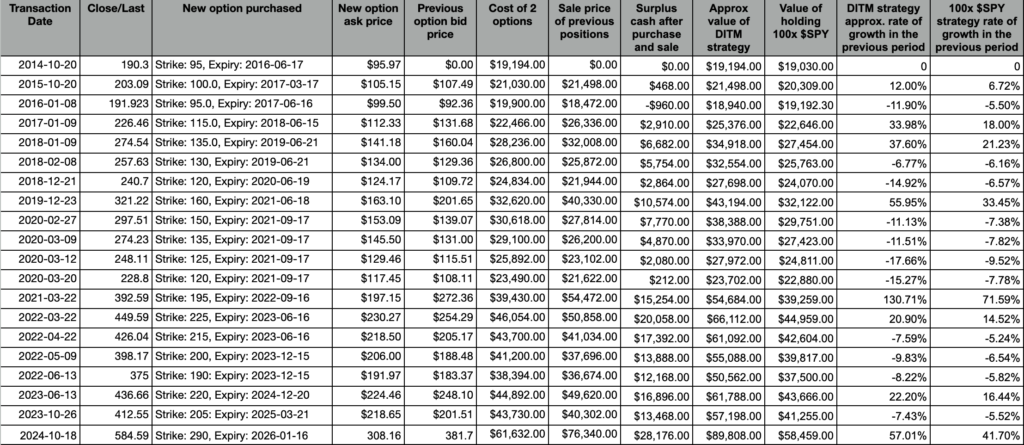

Enough hand-waving. Let’s look at how much money this strategy works compared to holding $SPY using real data. This backtest starts on Oct 20, 2014 and ends on Oct 18 2024.

On 2024-10-18, the bid price of the Strike: 290: Expiry: 2026-01-16 option was $304.81. This means the total value of the deep-in-the-money call option strategy had a total value of $89138, a 464% return on the initial capital of $19194 over the 10 year period. Holding 100 $SPY positions resulted in a total value of $58459, a 307% return on the initial capital of $19030 over the 10 year period.

There are some notable things to point out in the backtest:

- The main factor in why this strategy outperforms is due to the accumulating amount in the surplus cash column.

- You’ll notice that the surplus cash increases over time and is almost enough after 10 years to purchase an additional options position. If an additional options position is purchased, the deep-in-the-money strategy may start to outperform the 100x $SPY long position at an accelerated rate.

- The strategy can probably be improved to provide even greater performance if less sales and purchases were used. I would guess that the strategy could work better if it waited for a 10% downturn before making a defensive repositioning or if it waited to a month away from expiration before selling. Performance may also improve if 2 to 3 year expirations were used instead of 1.5.

- For the sake of readability, I didn’t log the bid price for each option position, which would technically reflect the real value of the options at each step. However, the difference is minimal and doesn’t change my overall conclusion that this deep-in-the-money strategy may outperform a traditional buy-and-hold index fund strategy over the long term.

- Getting caught with a negative surplus at the time of purchasing the next tranche of options may mean you don’t have enough of a balance to complete the purchase. For this reason, I propose using this strategy for only a portion of your long-term investment portfolio, targeting something like a maximum of 75% of your portfolio for this strategy. Draw down from the rest of the portfolio to help fund the options purchase if needed.

Limitations of this analysis

The Chicago Board Options Exchange opened in 1973 which defined the beginning of the modern options market. Accessing good data for options prices going back to the inception of the options market is difficult, so I’ve limited the backtest to 10 years. When we’re considering this deep-in-the-money as a path to grow our retirement nest eggs, we have to acknowledge that applying the analysis to a single 10 year period provides less confidence in its performance than the confidence from analysing the performance of holding an S&P 500 index fund over multiple bull and bear cycles over 100 years.

The backtest focuses on a 10-year period from 2014–2024, a time frame that largely encompasses a bull market, aside from short periods of volatility, like the COVID-19 pandemic crash and the 2018 crash. This means the strategy’s performance during more extended bear markets remains untested, and its real-world viability may differ over different economic cycles.

The options market can be kind of crazy during periods of extreme market volatility, like 2008, which I haven’t included in the backtest due to the data quality issue I mention above. If I get enough interest, I will try to recreate a backtest that is inclusive of 2008. As of today, I don’t have great options data to perform such a test. I’m not ashamed to publish my analysis in light of this admission because I speculate the defensive repositioning steps performed in a 2008-style market downturn would provide significant protections.

Conclusion

I conclude that using a long-dated, deep-in-the-money $SPY call option strategy is a low expense method of investing which comes with similar stability to investing in broad market index funds yet may outperform their returns significantly over long periods. The performance of the strategy may accelerate over time because the greater returns allow for new deep-in-the-money call options to be purchased. There would be significant downside risk if the strategy didn’t include a defensive repositioning during a market downturn. I believe that the deep-in-the-money will continue to outperform buying and holding broad market index funds especially as technology advances and options liquidity continues to increase. While this strategy may accelerate over time, significant drawdowns during severe market downturns could cause substantial losses early in the investment cycle, possibly requiring substantial cash top-ups. This strategy really deserves testing in a serious bear market to shed more light on this strategy’s risk to investors’ portfolios.